APJ ABDUL KALAM TECHNOLOGICAL UNIVERSITY Previous Years Question Paper & Answer

Semester : TRIMESTER 3

Subject : Financial Management II

Year : 2017

Term : APRIL

Branch : MBA

Scheme : 2015 Full Time

Course Code : 32

Page:1

31180021

Reg. No. Name:

APJ ABDUL KALAM TECHNOLOGICAL UNIVERSITY

THIRD TRINIESTER MBA DEGREE EXAMINATION APRIL 2017

MBA 32 FINANCIAL MANAGEMENT 1

Max. Marks: 60 Duration: 3 Hours

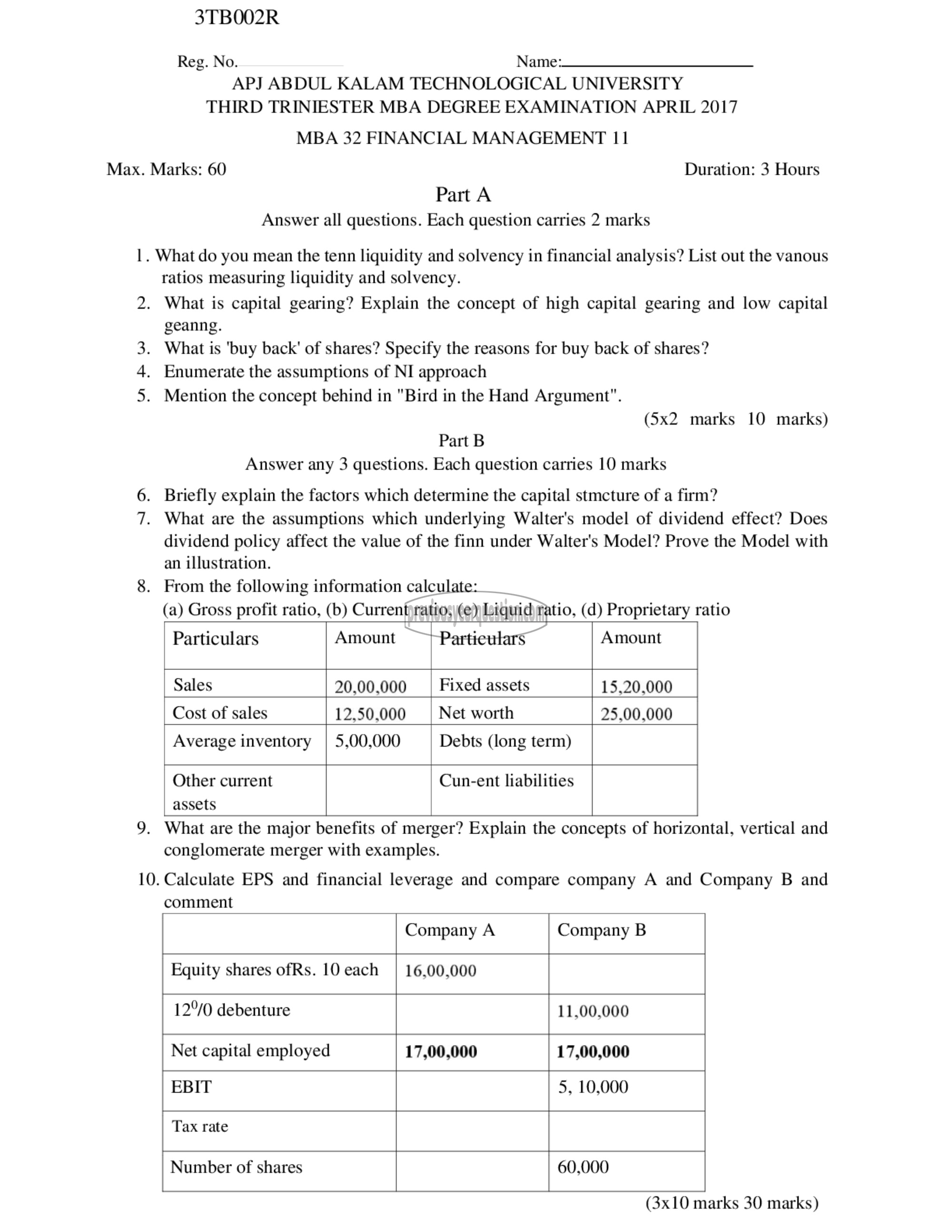

Part A

Answer all questions. Each question carries 2 marks

1. What do you mean the tenn liquidity and solvency in financial analysis? List out the vanous

ratios measuring liquidity and solvency.

2. What is capital gearing? Explain the concept of high capital gearing and low capital

geanng.

3. What is 'buy back' of shares? Specify the reasons for buy back of shares?

Enumerate the assumptions of NI approach

5. Mention the concept behind in "Bird in the Hand Argument".

حر

(5x2 marks 10 marks)

Part B

Answer any 3 questions. Each question carries 10 marks

6. Briefly explain the factors which determine the capital stmcture of a firm?

7. What are the assumptions which underlying Walter's model of dividend effect? Does

dividend policy affect the value of the finn under Walter's Model? Prove the Model with

an illustration.

8. From the following information calculate:

(a) Gross profit ratio, (0) Current ratio, (6) Liquid ratio, (d) Proprietary ratio

Particulars Amount Particulars Amount

Sales 20,00,000 | Fixed assets 15.20.000

Cost of sales 12.50.000 Net worth 25.00.000

Average inventory | 5,00,000 Debts (long term)

Other current Cun-ent liabilities

assets

9. What are the major benefits of merger? Explain the concepts of horizontal, vertical and

conglomerate merger with examples.

10. Calculate EPS and financial leverage and compare company A and Company B and

comment

Company A Company B

Equity shares ofRs. 10 each | 16,00,000

12°/0 debenture 11,00,000

Net capital employed 17,00,000 17,00,000

EBIT 5, 10,000

Tax rate

Number of shares 60,000

(3x10 marks 30 marks)