APJ ABDUL KALAM TECHNOLOGICAL UNIVERSITY Previous Years Question Paper & Answer

Semester : TRIMESTER 3

Subject : Marketing Management II

Year : 2017

Term : APRIL

Branch : MBA

Scheme : 2015 Full Time

Course Code : 31

Page:1

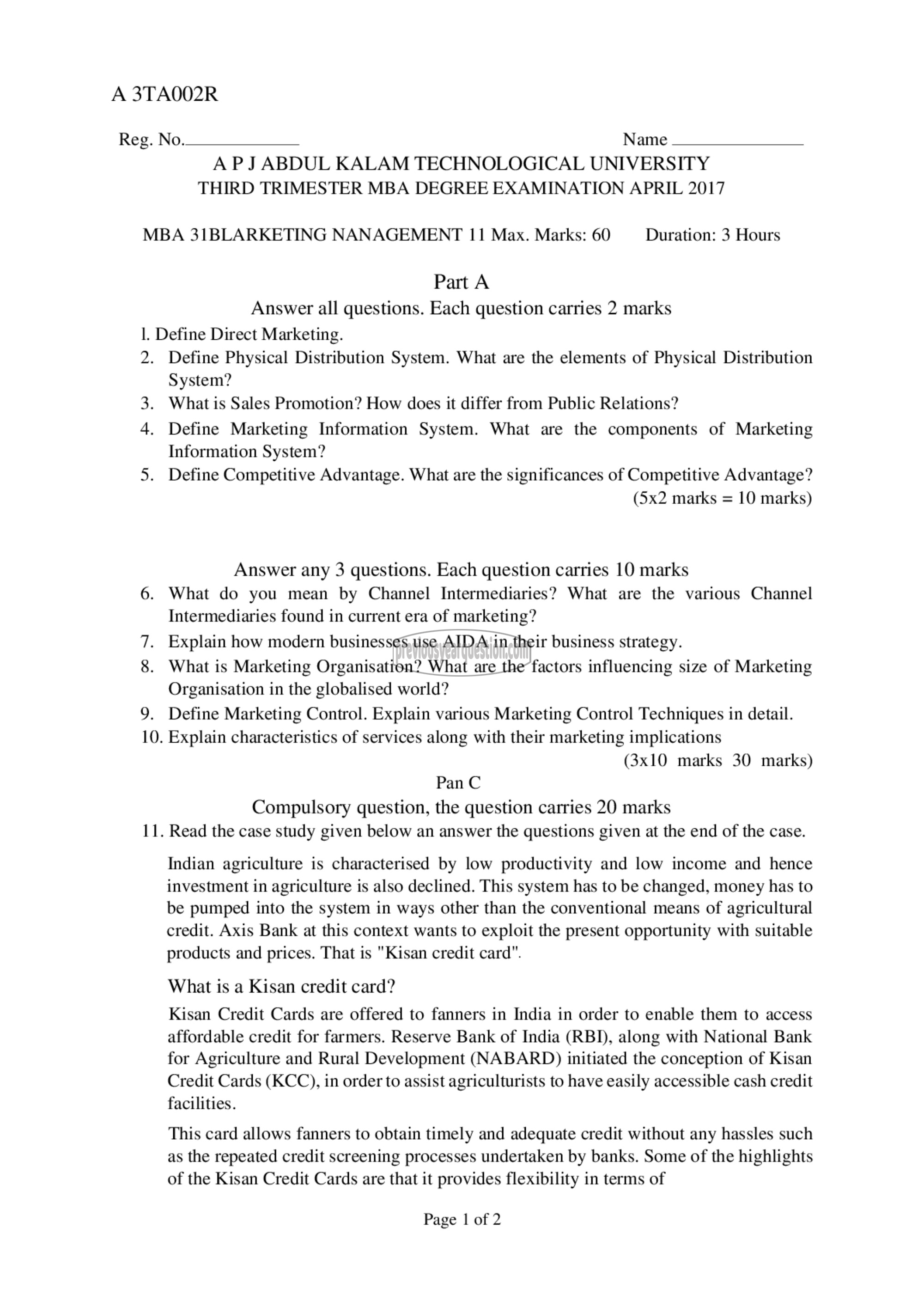

A 3TA002R

Reg. No, Name

A PJ ABDUL KALAM TECHNOLOGICAL UNIVERSITY

THIRD TRIMESTER MBA DEGREE EXAMINATION APRIL 2017

MBA 31BLARKETING NANAGEMENT 11 Max. Marks: 0 Duration: 3 Hours

Part A

Answer all questions. Each question carries 2 marks

1. Define Direct Marketing.

2

3.

11.

Define Physical Distribution System. What are the elements of Physical Distribution

System?

What is Sales Promotion? How does it differ from Public Relations?

Define Marketing Information System. What are the components of Marketing

Information System?

Define Competitive Advantage. What are the significances of Competitive Advantage?

(5x2 marks = 10 marks)

Answer any 3 questions. Each question carries 10 marks

What do you mean by Channel Intermediaries? What are the various Channel

Intermediaries found in current era of marketing?

Explain how modern businesses use AIDA in their business strategy.

What is Marketing Organisation? What are the factors influencing size of Marketing

Organisation in the globalised world?

Define Marketing Control. Explain various Marketing Control Techniques in detail.

. Explain characteristics of services along with their marketing implications

(3x10 marks 30 marks)

Pan C

Compulsory question, the question carries 20 marks

Read the case study given below an answer the questions given at the end of the case.

Indian agriculture is characterised by low productivity and low income and hence

investment in agriculture is also declined. This system has to be changed, money has to

be pumped into the system in ways other than the conventional means of agricultural

credit. Axis Bank at this context wants to exploit the present opportunity with suitable

products and prices. That 15 "Kisan credit card”.

What is a Kisan credit card?

Kisan Credit Cards are offered to fanners in India in order to enable them to access

affordable credit for farmers. Reserve Bank of India (RBI), along with National Bank

for Agriculture and Rural Development (NABARD) initiated the conception of Kisan

Credit Cards (KCC), in order to assist agriculturists to have easily accessible cash credit

facilities.

This card allows fanners to obtain timely and adequate credit without any hassles such

as the repeated credit screening processes undertaken by banks. Some of the highlights

of the Kisan Credit Cards are that it provides flexibility in terms of

Page | of 2